are property taxes included in mortgage in texas

400000 50000 350000. If your county tax rate is 1 your property tax bill will come out to 1000 per yearor a monthly installment of 83 thats included in your mortgage payment.

Property Taxes 101 Understanding Your Property Tax Propel Tax

When solely paying as part of the mortgage there is no interest accrued.

. If your home was assessed at 400000 and the property tax rate is 062 you would pay 2480 in property taxes 400000 x 00062 2480. Can You Deduct Property Taxes In Texas. In Travis County your property taxes on a 250000 home would be 4933 while in Harris County youd pay 5648.

If your home was assessed at 400000 and the property tax rate is 062 you would pay 2480 in property taxes 400000 x 00062 2480. Property taxes in Texas are known for being quite high compared to the rest of the country. The tax on cigarettes at 141 per pack.

The amount each homeowner pays per year varies depending on local tax rates and a propertys assessed value. Whether you pay toward property taxes each month through a mortgage escrow account or just once-yearly directly to your local government is a choice youll make. If you qualify for a 50000 exemption you would subtract that from the assessed value then multiply the new amount by the property.

The average effective property tax rate is 169 which is good for seventh-highest in the US. Are Property Taxes Included In Mortgage Payments. Heres how to do that math by the way.

Thats 167 per month if your property taxes are included in your mortgage or if youre saving up the money in a sinking fund. The new tax law caps the amount of deductible mortgage interest at a maximum mortgage amount of 750000. Tax Code Section 1113 b requires school districts to provide a 40000 exemption on a residence homestead and Tax Code Section 1113 n allows any taxing unit to adopt a local option residence homestead exemption of up to 20 percent of a propertys appraised value.

Is Texas Property Tax Included In Mortgage. Factors in Your Texas Mortgage Payment. 200000 x 1 tax rate 2000 taxes owed.

The local option exemption cannot be less than 5000. Use this free Texas Mortgage Calculator to estimate your monthly payment including taxes homeowner insurance principal and interest. Of these MO taxes the school district portion is the largest.

Its one of the first things to add to your housing budget if youre planning on buying a home in the state. If you qualify for a 50000 exemption you would subtract that from the assessed value then multiply the new amount by the property tax rate. Statewide the effective property tax is 186 the sixth highest rate in the country.

A mortgage banker or licensed residential mortgage loan originator should complete and send a complaint form to the Texas Department of Savings and Mortgage Lending 2061 North. When a homebuyer includes the property tax with monthly payments it could mean a changing mortgage amount. Lets say your home has an assessed value of 100000.

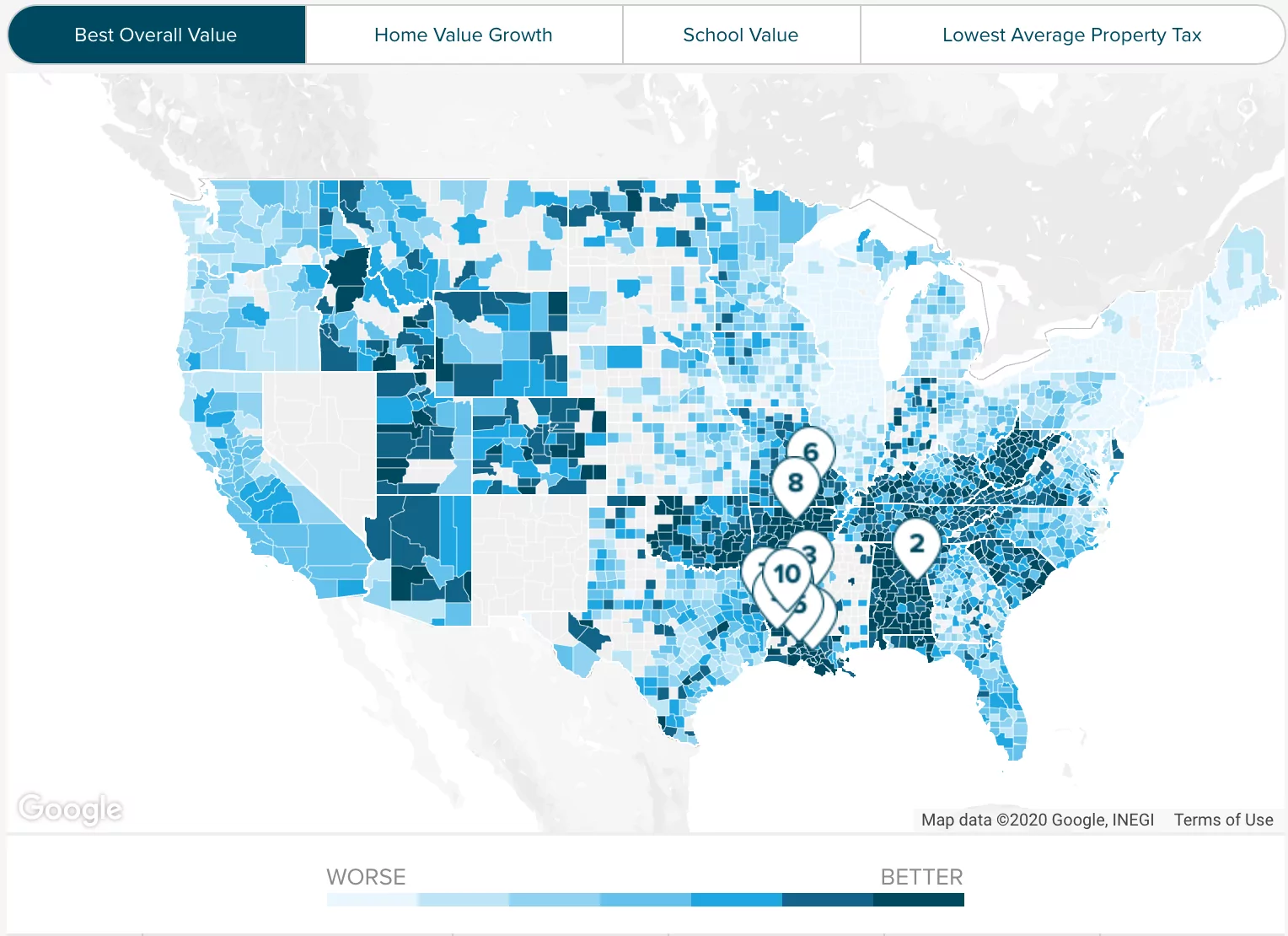

Because property taxes vary between counties you could pay more in taxes for the same house in a different area. The other portion of your property tax bill goes to the interest and sinking IS fund which pays down local debt. Property taxes are local taxes that provide the largest source of money local governments use to pay for schools streets roads police fire protection and many other services.

There is no state property tax. If youre unsure of how and when you must pay real estate taxes know that you might be paying them along with your monthly mortgage. The direct payment means a reduced monthly payment for the home owners mortgage because the escrow fund isnt included.

Property Tax Relief Available To Texas Homeowners Through Homestead Exemptions The Texas Tribune. The new Tax Cuts and Jobs Act took effect on January 1 2018 and includes a few important changes to the tax code that may affect both new and existing homeowners. Is Property Tax Included in Mortgage Payments.

Any interest paid on mortgage debt exceeding this cap is no longer deductible. 13 2022 Published 659 am. Some additional taxes in Texas include.

When youre buying a home with a mortgage an escrow account is often included to help with the handling of related expenses such as property tax and home. Franchise tax is 375 for wholesalers and retail businesses and 75 for other non-exempt businesses. If your county tax rate is 1 your property tax bill will come out to 2000 per year.

Property taxes can be included in your mortgage payment at your option if your loan-to-value LTV ratio is less than 80. A deduction on the state and local taxes can include a state and local income tax deduction as well as the state and local property taxesHowever there is a maximum deduction of 10000 5000 if. On a 327700 house the median home price for Q1 2021 in NJ that means 675 per month and 8108 per year in property taxes.

Texas law establishes the process followed by local officials in determining the value for property ensuring that values are equal and. Property Tax System Basics. Learn more about Texas property taxes.

Typically states will charge somewhere around 55 for each 500 of value. The homeowner can create a savings account and receive interest payments towards paying the property tax. Your property taxes are included in your monthly home loan payments.

The gas tax which is 20 cents per gallon on diesel and unleaded fuels. Paying property taxes is inevitable for homeowners. So if youre putting down 20 or more on a purchase transaction then typically you would have to option not to escrow your property taxes.

Hotel tax is 6 of the cost of the room. But well get into that later. The higher the value the higher the tax bill.

Most property taxes 80 are collected from taxpayers for the maintenance and operations MO of a local governments day-to-day expenses. Thats 167 per month if your property taxes are included in your mortgage or if youre saving up the money in a sinking fund.

Appealing Your Property Taxes A Primer Spring Is Here And That Means It S Time To Well It S Time To Appeal Your Propert Property Tax Property Home Mortgage

Chart Current Mortgage Closing Costs Listed By State Closing Costs Mortgage Interest Mortgage

Are Property Taxes Included In Mortgage Payments Smartasset Mortgage Payment Paying Off Mortgage Faster Mortgage

Basics Of Property Taxes Mortgagemark Com

Purchasing A Home Is More Than Just The Initial Downpayment Between Utilities A Downpa Anzahlung Erstes Eigenheim Initialen

Deducting Property Taxes H R Block

Purchasing A Home Is More Than Just The Initial Downpayment Between Utilities A Downpa Anzahlung Erstes Eigenheim Initialen

Property Tax How To Calculate Local Considerations

What S Included In Your Mortgage Payment To Know More Call Us On 1 800 756 0809 Or Visit Us At Www Compareclosing C In 2021 Mortgage Payment Refinance Rates Mortage

Received A Tax Bill And Not Sure What To Do With It A N Mortgage

Pin On Fairway Mortgage Colorado

Harris County Tx Property Tax Calculator Smartasset

Common Home Loan Mistakes Home Loans Home Equity Loan

Property Tax Prorations Case Escrow

What Is A Homestead Exemption And How Does It Work Lendingtree

Why Are Texas Property Taxes So High Home Tax Solutions

Who S Responsible For Property Taxes On A Reverse Mortgage

The Purchasing Process On How To Buy A Home From Hot On Homes It Is A Weekly Colorado Springs Real Colorado Springs Real Estate Colorado Springs Spring Living